AD | Featured

Being a parent means having numerous responsibilities. From ensuring everyone has eaten to helping children with homework. Sometimes you get busy to the extent of forgetting other important things such as planning your personal finances.

Without a proper financial plan, your family is at risk of suffering in case of an emergency. That’s why you should do everything possible to ensure that your family is financially secure.

Getting your personal finances in order

If you don’t know where to start, the best option is to seek help from a professional financial planner. A financial planner will be able to guide you on different ways to put your personal finances in order.

Below are some personal finance tips for busy parents:

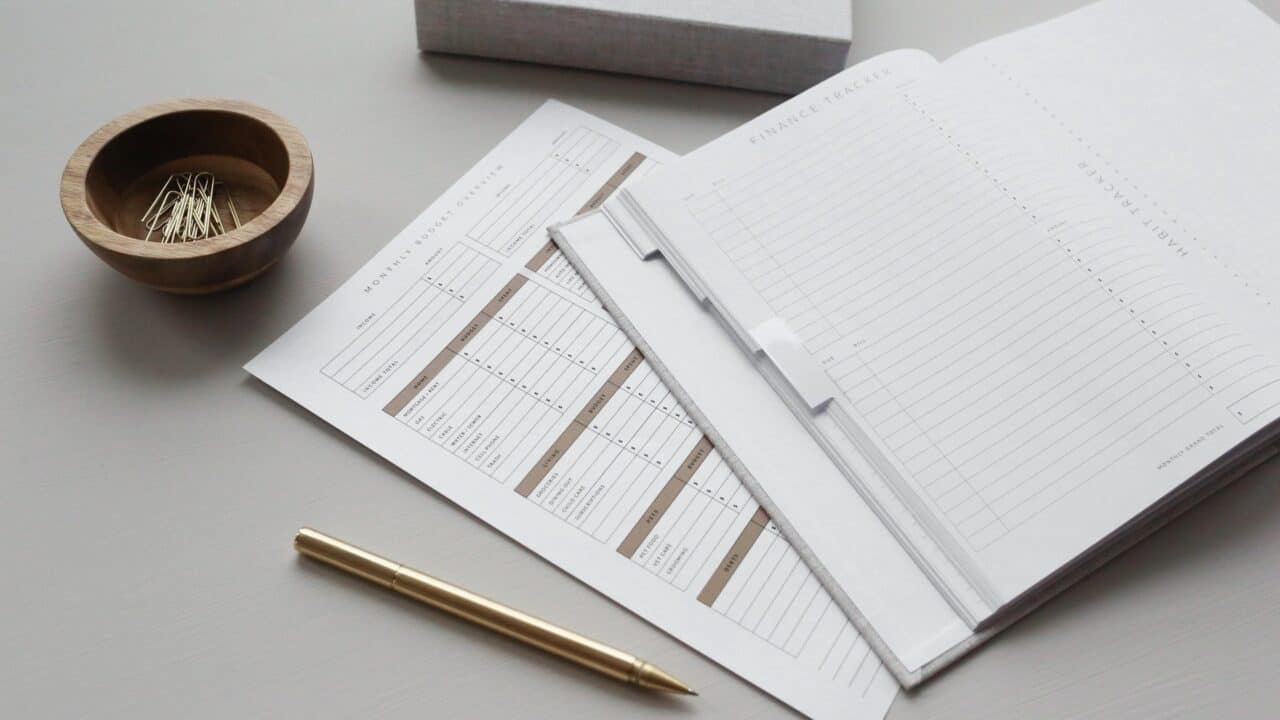

Create a household budget

A household budget is essential for busy parents because it helps cut down on unnecessary spending. It is easy to engage in impulse buying if you don’t have a budget. This makes it difficult to save money.

One thing about having a budget is that it instills financial discipline. For example, you will always stick to what you had planned to use. Besides, a budget will also help you to track all family expenses and avoid wastage.

Switch to a credit union

Credit unions are formed with the idea of people helping each other. That’s why joining a credit union is the best idea for busy parents.

The moment you join a credit union, you automatically become one of the owners. This means you will be entitled to certain privileges such as quick approval of loans and low-interest rates.

Joining a credit union as a family automatically also shields you from financial emergencies. Besides, you will also have access to a credit union card. The benefits of using a credit union credit card include the following:

- Lower interest rates

- Personalized credit care

- Cash advance at any time

Develop a saving culture

As a family, you need to build a culture of saving as early as possible. For example, teach your children the importance of money and saving immediately they attain the age of accountability. The best way to do this is to give each one of them a home bank and ensure that they save every time.

You should also learn to save at every opportunity that you get. For example, avoid spending money on things you can do without and save that money on a separate account.

Create an emergency account

It’s important to always prepare your family for financial emergencies. You don’t know what will happen tomorrow.

That’s why you should put money aside in case of emergencies. This will prevent you from using everything you have saved in case an unexpected thing happens.

Insurance cover

Last but not least, ensure that you have insurance cover for your family. There are many insurance policies that cater to various family needs.

For example, you can have an education policy for your child or children. You can also take out life insurance policies for yourself and your family members.

In general, being a busy parent can sometimes make you forget important things such as planning your finances. However, taking early precautions can help protect your family financially.

No Comments