Featured

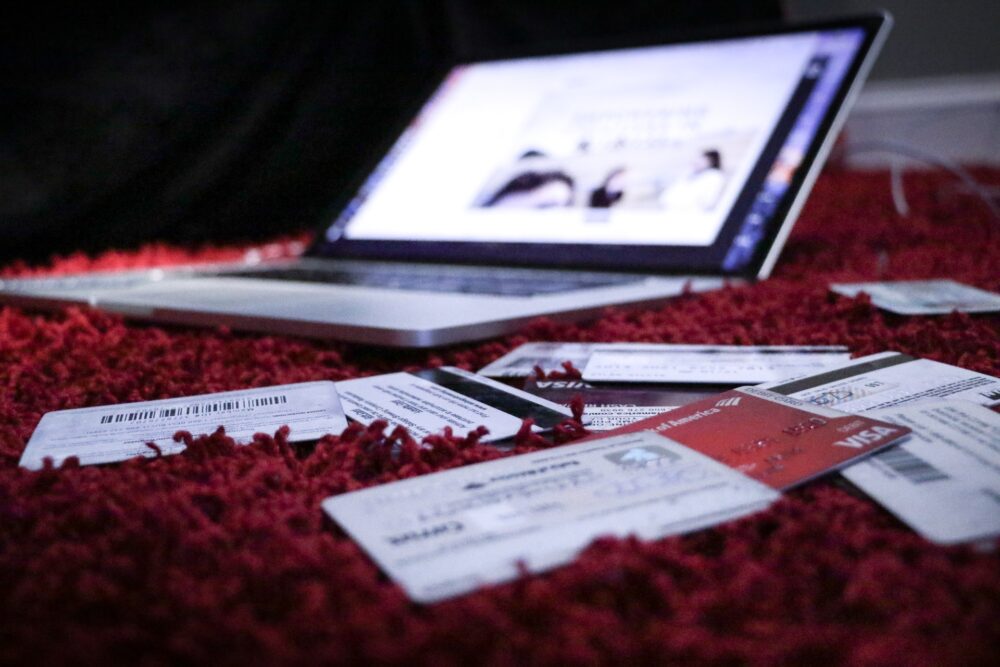

Debt can be a heavy burden that affects not only your financial well-being but also your overall quality of life. Whether it’s credit card debt, student loans, medical bills, or any other form of financial obligation, the stress and anxiety that debt brings can be overwhelming. However, it’s important to remember that you’re not alone in this struggle, and there are effective strategies for overcoming debt problems.

In this blog post, we’ll explore some practical and actionable steps to help you regain control of your finances and work towards a debt-free future.

Actionable steps to overcome debt problems

Assess Your Financial Situation

The first step in overcoming debt problems is to gain a clear understanding of your financial situation. Start by creating a detailed list of all your debts, including the amount owed, interest rates, and minimum monthly payments. Additionally, you can check out the Lighthouse Finance Solutions review for an option to negotiate a lower payment with your creditors. All this will give you a comprehensive overview of your financial obligations and help you prioritize your debts.

Create a Realistic Budget

Once you have a clear picture of your debts, it’s time to create a realistic budget. A budget helps you track your income and expenses, allowing you to identify areas where you can cut back and allocate more funds toward debt repayment. Be sure to include all your monthly expenses, such as rent or mortgage, utilities, groceries, transportation, and entertainment. The key to a successful budget is sticking to it consistently.

Prioritize Your Debts

Not all debts are created equal. Some may have higher interest rates, while others may be more urgent due to legal consequences if left unpaid. Consider prioritizing your debts using one of the following strategies:

a. Snowball Method: Start by paying off the smallest debt first while making minimum payments on the rest. Once the smallest debt is paid off, roll that payment amount into the next smallest debt, creating a snowball effect.

b. Avalanche Method: Prioritize debts with the highest interest rates first. This approach can save you money in the long run by reducing the amount of interest you pay.

c. Combination Approach: Combine elements of both the snowball and avalanche methods to create a customized strategy that works for you.

Increase Your Income

To accelerate your debt repayment, consider finding ways to increase your income. This could involve taking on a part-time job, freelancing, selling unused items, or pursuing opportunities for career advancement. Every additional dollar you earn can be put toward paying down your debts more quickly.

Negotiate with Creditors

Don’t hesitate to reach out to your creditors to explore options for debt relief. They may be willing to negotiate lower interest rates, extend repayment terms, or offer hardship programs to help you manage your debt more effectively. Be honest and transparent about your financial situation when discussing these options.

Consolidate Your Debts

Debt consolidation involves taking out a single loan to pay off multiple debts. This can simplify your debt repayment process by combining your various obligations into one monthly payment with a potentially lower interest rate. Be cautious, though, as debt consolidation loans can sometimes lead to further debt if not managed wisely.

Seek Professional Help

If your debt problems are overwhelming, it may be beneficial to seek professional assistance. Credit counseling agencies and debt management programs can provide expert guidance and negotiate with creditors on your behalf. Be sure to research and choose a reputable organization to assist you.

Cut Unnecessary Expenses

Reducing unnecessary expenses can free up more money for debt repayment. Review your budget to identify areas where you can cut back, such as dining out less frequently, canceling unused subscriptions, or finding more cost-effective alternatives for everyday expenses.

Build an Emergency Fund

While it may seem counterintuitive to save money while in debt, having an emergency fund can prevent you from falling deeper into debt when unexpected expenses arise. Start by setting aside a small amount each month until you have enough to cover at least three to six months’ worth of living expenses.

Stay Motivated and Persistent

Overcoming debt problems is not a sprint; it’s a marathon. Stay motivated by setting realistic goals and tracking your progress. Celebrate small victories along the way, and remember that setbacks are a part of the journey. The key is to stay persistent and keep moving forward, even when the road gets tough.

Dealing with debt problems can be challenging, but with the right strategies and a commitment to financial discipline, you can overcome them. Assess your financial situation, create a budget, prioritize your debts, increase your income, and explore options like debt consolidation and professional help when necessary.

By taking these steps and staying motivated, you can regain control of your finances and work towards a debt-free future, ultimately achieving the financial freedom and peace of mind you deserve.